Tesla TSLA will be one of the heavy hitters reporting earnings this week with the auto giant scheduled to release its fourth quarter financial results on Wednesday, January 24.

Going into its Q4 report Tesla’s stock is up a very respectable +46% over the last year but shares have dipped -15% at the start of 2024. With that being said, let’s see if it is time to buy the recent pullback as earnings approach.

Image Source: Zacks Investment Research

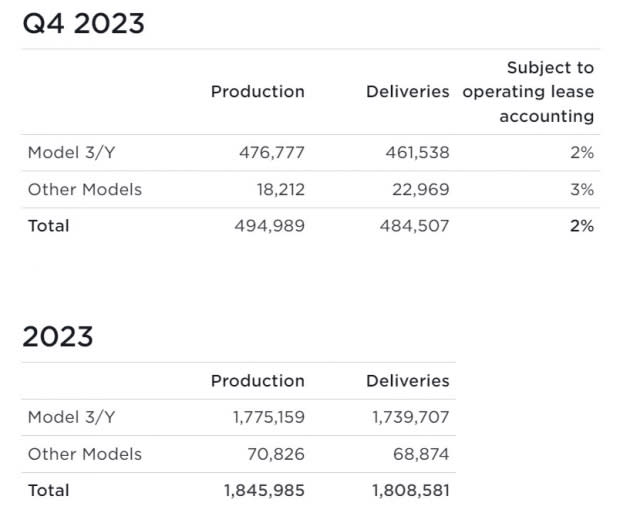

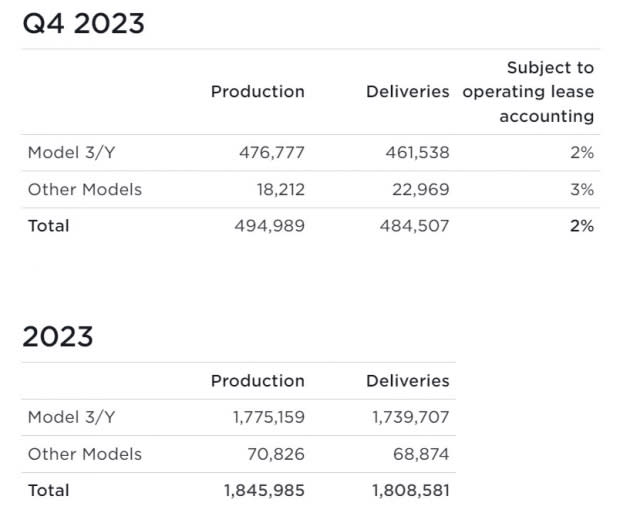

Deliveries & Market Share

Tesla had 484,507 total deliveries during Q4 keeping the company in the running as the global EV leader with a stronghold on the domestic market ahead of competitors like General Motors GM and Ford F. Fourth quarter deliveries were up 19% year over year as Tesla’s Model Y and Model 3 remain the top-selling EVs in the United States ahead of General Motors’ Chevrolet Bolt, Rivian’s RIVN R1T/R1S, and Ford’s Mustang Mach-E.

Tesla is thought to control just over 50% of the domestic EV market and posted total annual deliveries of just over 1.8 million EVs which represented 38% growth YoY.

Image Source: Tesla Investor Relations

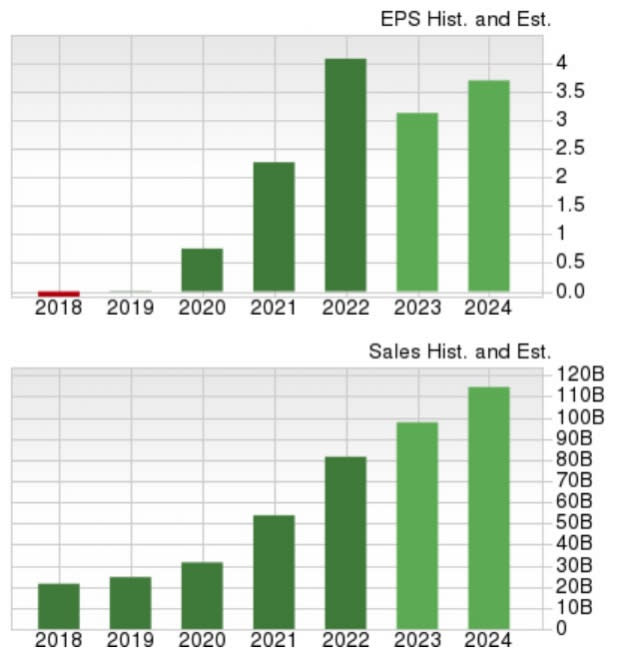

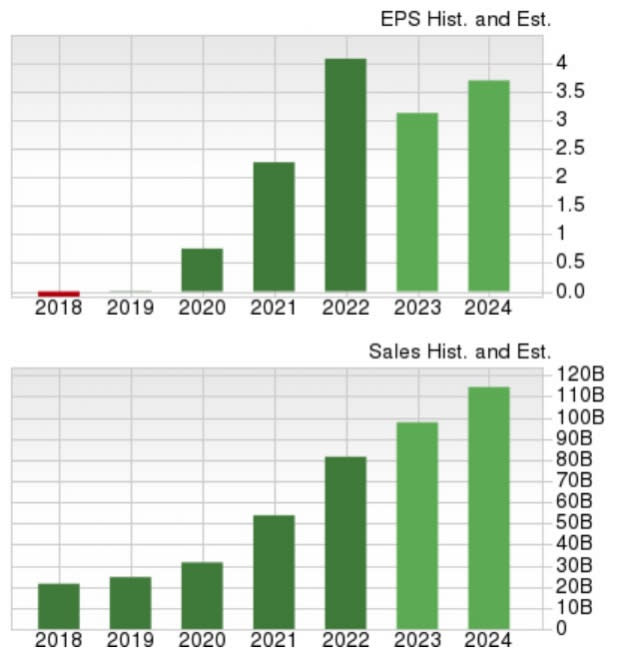

Q4 Financial Preview & Outlook

Despite reporting another record for annual deliveries, Tesla’s Q4 earnings are projected to dip to $0.74 a share compared to $1.19 per share in the prior-year quarter. This may be indicative of Tesla’s price cuts and goal of a more affordable EV lineup as quarterly sales are projected to be up 6% to $25.94 billion despite the lowered profability.

Overall, Tesla is now expected to round out its fiscal 2023 with annual earnings down -22% to $3.16 a share versus $4.07 per share in 2022. However, FY24 EPS is forecasted to rebound and jump 21% to $3.82 per share. Optimistically, total sales are anticipated to have climbed 20% in FY23 and are projected to expand another 20% this year to $117.47 billion.

Image Source: Zacks Investment Research

Tesla’s Valuation is More Reasonable

Following the recent selloff in Tesla’s stock, its 55.5X forward earnings multiple might still seem lofty but this is well below its decade-long highs and even 44% below its one-year high of 100.5X while at a 30% discount to the median of 79.9X.

Image Source: Zacks Investment Research

Plus, Tesla’s price-to-sales ratio is also contracting to be more reasonable and is currently at 5.7X compared to highs of 9.2X over the last year and a median of 7.3X.

Image Source: Zacks Investment Research

Bottom Line

Fourth quarter financial results will play a large part in the potential for more upside in Tesla shares but the EV pioneer remains one of the most intriguing growth stocks. Furthermore, the recent correction may be an opportunity, especially for longer-term investors with Tesla’s stock currently sporting a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report