Fintech CRED secures in-principle approval for payment aggregator license

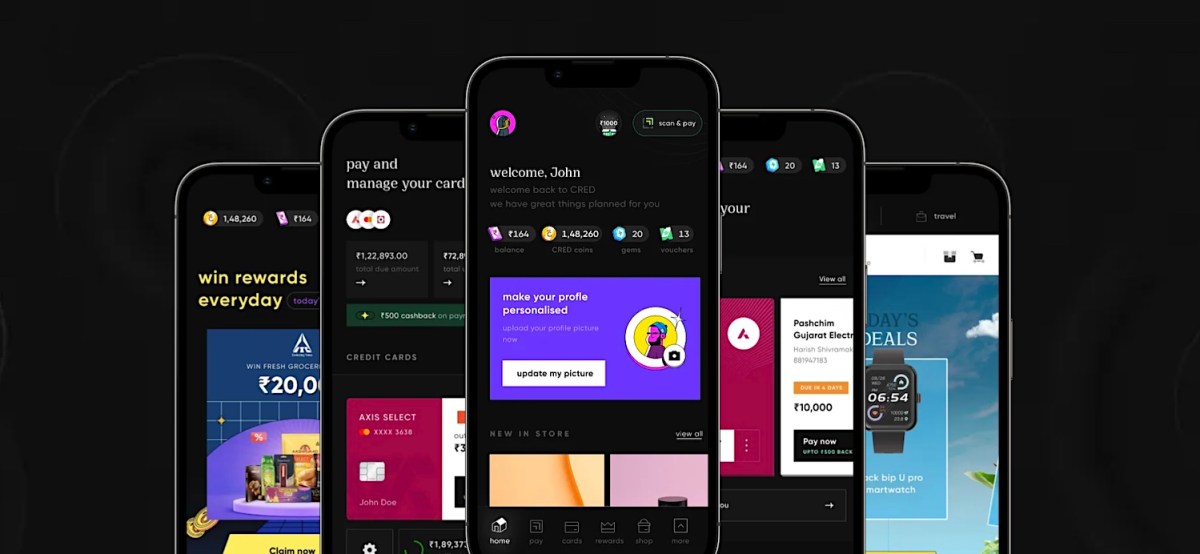

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could help it better serve its customers and launch new products and experiment with ideas faster. The Bengaluru-headquartered startup, valued at $6.4 billion, received the in-principle approval from the Reserve Bank of India for the payment …